AMC Theatres Furloughs Over 25,000 Employees, Stops Paying Rent, And Has Its Credit Downgraded

Last week, S&P Global downgraded AMC Entertainment Holdings Inc.’s issuer credit rating, stating that the company would not be able to recover from the impact of the Coronavirus pandemic.

Their credit was reduced to CCC- from B. S&B Global explained the credit rating downgrade, “The rating agency expects AMC Theatres to remain closed beyond June due to the impact of the coronavirus and does not believe the company has sufficient sources of liquidity to cover its expected negative cash flows.”

They added, “S&P expects the company to breach its 6x net senior secured leverage covenant when tested on Sept. 30, absent a waiver from its lenders.”

S&P Global concluded, “The outlook on the company is negative, reflecting the rating agency’s expectation that there could be a liquidity shortfall within the next six months, absent some form of incremental financing. The outlook also reflects the potential for a distressed debt exchange over the next six months.”

Which essentially means (as I understand it) that AMC doesn’t have any money coming in. It’s borrowing too much to continue operating while it has shuttered its theaters nationwide. And AMC’s debts are going to get scrutinized by their lenders in September and they’ll have to make a decision about making any more contributions to the theaters going forward.

AMC, who was purchased by China’s Dalian Walda in 2012 for $2.6 billion, had announced back in March they were shuttering all of their theaters “in compliance with local, state, and federal COVID-19 directives.” At the time they believed they would be shut down for 6-12 weeks.

In compliance with local, state, and federal #COVID19 directives, all #AMCTheatres locations are now closed for at least 6-12 weeks. AMC Stubs A-List memberships will be paused automatically during the time AMC theatres are closed.

— AMC Theatres (@AMCTheatres) March 17, 2020

There’s a possibility that AMC could use funds through the government’s stimulus package in response to the coronavirus outbreak. It would reduce its borrowings and allow them to weather the storm that has shuttered their doors until such a time when they can safely reopen.

AMC Furloughs Employees, Stops Paying Rent

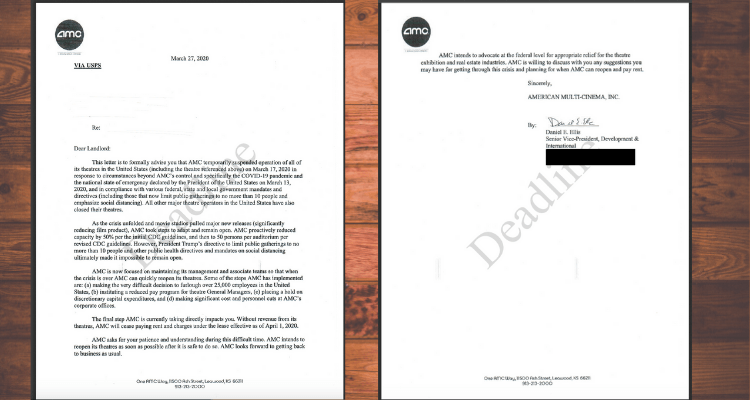

A letter obtained by Deadline from Senior Vice-President of Development & International Daniel E. Ellis to an AMC landlord details the company furloughed 25,000 employees and will no longer be paying rent to the unnamed landlord.

Ellis writes, “Some of the steps AMC has implemented are: (a) making the very difficult decision to furlough over 25,000 employees in the United States, (b) instituting a reduced pay program for theatre General Managers, (c) placing a hold on discretionary capital expenditures, and (d) making significant cost and personnel cuts at AMC’s corporate office.”

He also adds, “The final step AMC is currently taking directly impacts you. Without revenue from its theatres, AMC will cease paying rent and charges under the lease effective as of April 1, 2020.”

“AMC intends to advocate at the federal level for appropriate relief for the theatre exhibition and real estate industries. AMC is willing to discuss with you any suggestions you may have for getting through this crisis and planning for when AMC can reopen and pay rent,” concludes the letter.

AMC Struggling Before Coronavirus

The year 2019 had record breaking box office numbers, with several blockbuster films as well as really great auteur movies coming out. However, AMC ran a deficit losing more than $100 million in that same year. The company reports a total deficit of five billion plus dollars as well as losses of $149 million.

Given the current year for the theater chain, it’s unlikely that they’ll bounce back. For the future of the movie business it could certainly mean less screens for studios to show their films. And this could translate to lower box office numbers. Imagine 2019 without AMC theaters- and how much that would impact those billion dollar box office films.

There’s a bit of uncertainty as to if those films would even get close to those kinds of dollar amounts. Some sites such as Deadline have speculated that Chapter 11 bankruptcy could be an option to help the struggling theater chain.

AMC touts 1,000 theaters and 11,000 screens across the globe. Imagine losing all of those in 2021. Especially with all those films coming out next year that’ve been moved from this year. In the short term of it, AMC might have to reduce their theaters. They will have to radically change some of their services to reduce operating costs and overhead.

Past Theater Struggles

This could also cause a lot of further inspection of other theaters and their financial health. Edwards, Cinemark, Arclight, Harkins, Regal and a number of other venues might land under the microscope. It all depends on how long the COVID-19 pandemic lasts. Looking at the market in broader terms, a number of businesses will have a rough time this year because of stay at home orders.

The theater industry is no stranger to struggles. Between 1999 and 2001, a number of theaters declared bankruptcy including Regal, Cineplex, Edwards, Mann, and UA. Their problem at the time was expanding was too fast. What ended up happening is the theater business was consolidated with Cineplex merging with AMC and Regal absorbing Edwards and United Theaters.

What do you think about this news regarding AMC’s current financial situation? Do you think they’ll recover? Or is this going to be a permanent change to our theatrical landscape once the lockdowns are over?

Sound off in the comments below or let’s talk about it on social media!

More About:Movies