CEO David Zaslav Reportedly Ignored 90% Of Advice From A Hollywood Insider To Get “Cash Flowing Again” At Warner Bros.

If 2022 has proven anything, it’s that Warner Bros. Discovery CEO David Zaslav is serious about turning the company into a net moneymaker again. To do that, he has to have money to spend, and even though there are billions in debt to pay down, the boss man is making it clear he is invested (pun intended) in getting the cash flowing again.

This is according to CNBC as the finance news outlet describes Zaslav’s strategy, one an expert close to him says will become his legacy. “Whenever I talk to David, the first thing I say is manage your cash,” WBD board member John Malone said. “Cash generation will ultimately be the metric that David’s success or failure will be judged on.”

And it’s not going to be an easy road. “It isn’t going to be overnight, and there’s going to be a lot of grumbling because you don’t generate $3.5 billion of operating synergies without, you know, breaking a few eggs today,” Malone added. $3.5B is the amount of cost Zaslav promised investors he would cut.

That’s higher than the initial promise of $3B, but cutting costs is only part of the objective. Cash is key, particularly loose cash that can be spent. Zaslav needs it to pay off some debt and he’s not getting a lot of it from operating activities, which was $1.5B for the first nine months of 2022.

Down from last year’s count of $1.9B, Zaslav also faces a negative free cash flow problem that turned Wall Street bearish on his company. At -$192 million in free cash flow, he has to convince them WBD is a safe investment and that long–term they can generate the kind of funds that the Hollywood conglomerate used to.

But to do that, he needs them to focus on a desirable unit of measure. “You should be measuring us in free cash flow and EBITDA [earnings before interest, taxes, depreciation, and amortization],” Zaslav said at a RBC Capital Markets investor conference last month. “We’re driving for free cash flow.” It sounds good but unfortunately, freeing up cash comes with sacrifices.

Employees are going to eat those words because more downsizing is coming. As of mid-December, thousands of people have been laid off this year and this is simply “a head start.” Says CNBC, “Zaslav is trying to give Warner Bros. Discovery a head start on what may be a year of downsizing among large media and entertainment companies.”

WBD expects the downsizing to yield them $3B in free cash flow this year, roughly $4B in 2023, and about $6B in 2024; additionally, the estimated 2023 EBITDA is $12B. Though those are internal estimates and a very high bar, the numbers give WBD a selling point over Disney who according to CNBC made just $1B of free cash flow this year.

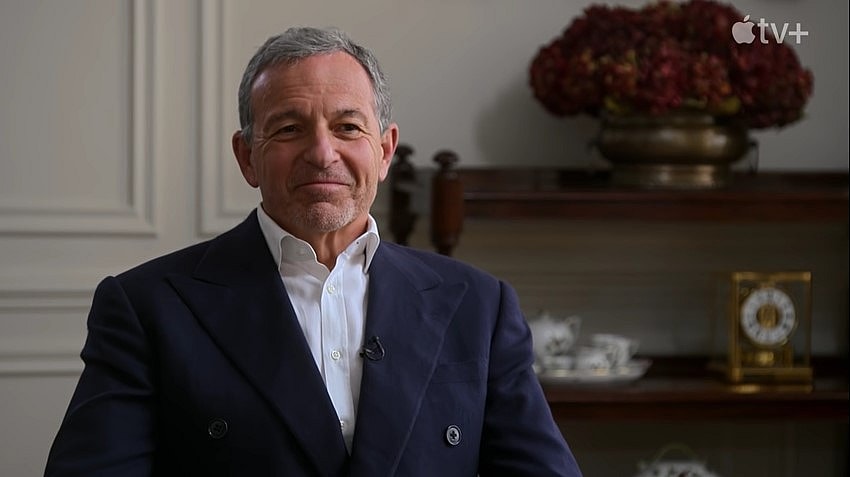

Despite the growth of Disney Plus and their theme parks, in reality, for all their growth, they are a drain because they are such a heavy investment. Disney’s operating income, $4.2B, was down 42 percent from last year and they look to refocus on making a profit now that Bob Iger is back in power as CEO.

Zaslav and Discovery on the other hand were a cash machine “generating over $3 billion in free cash flow for a long time.” Now that the merger with WB is in full effect he stares down the barrel of “$40 billion of revenue and almost no free cash flow, with all of the great IP that they have.”

Decisions he’s made, films he’s scrapped, and the coming overhaul of HBO Max have made him into a villain in the eyes of some who’d rather he put audiences ahead of stockholders. It’s a business-savvy thing to do but others say Zaslav has ignored 90 percent of the advice he’s given on how to run a business in Hollywood.

As much as that rings of irresponsibility, he counters he is merely being precise. “We’re going to spend more on content — but you’re not going to see us come in and go, ‘Alright, we’re going to spend $5 billion more,’” he said last February. “We’re going to be measured, we’re going to be smart and we’re going to be careful.”

And if you think Zaslav is acting blindly or wouldn’t be advised to act as he has so far, there are investors and firms who – seeing that the current Hollywood business model isn’t working – believe in what he is doing. “Incredible! Yes, Zaslav wants a profitable business, not the Debtflix model of cash burn & endless spending,” Masa Capital’s Twitter says to CNBC.

NEXT: Warner Bros. Discovery Being Sued For Inflating HBO Max Subscriber Numbers By Ten Million Users