Hasbro Loses Faith In Upcoming ‘Magic: The Gathering’ Crossover Sets, Downshifts Sales Predictions To “Single-Digit Revenue” Growth

It appears that, at least on some level, Hasbro is finally taking notice of the widespread and ever-growing criticisms against their 2026 emphasis on Universes Beyond, the toy manufacturing giant has downscaled their previous projections for Wizards of the Coast’s annual Magic: The Gathering sales, with their previous boasting that one forthcoming crossover set will match the success of Final Fantasy now giving way to a meager hope for “single-digit” revenue growth.

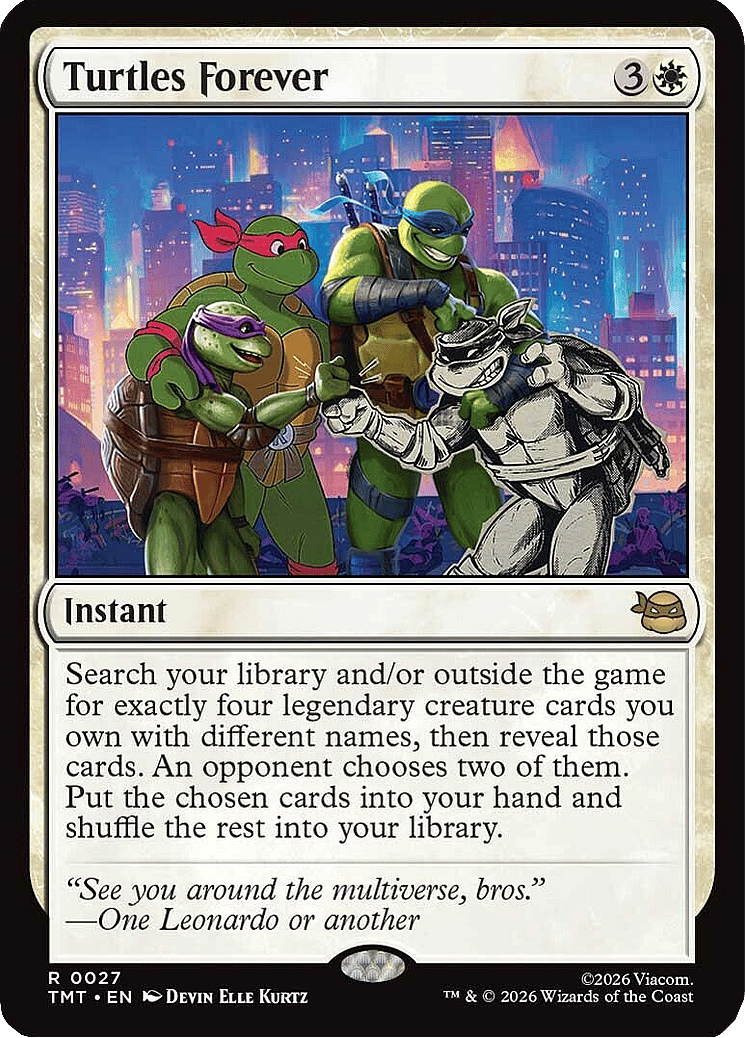

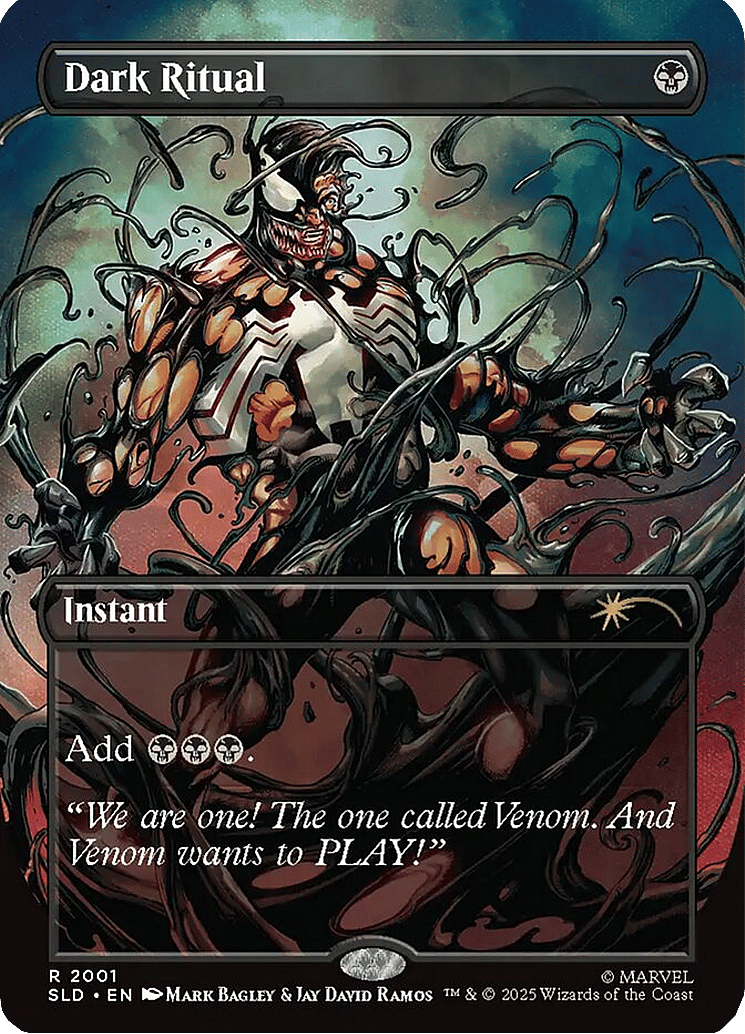

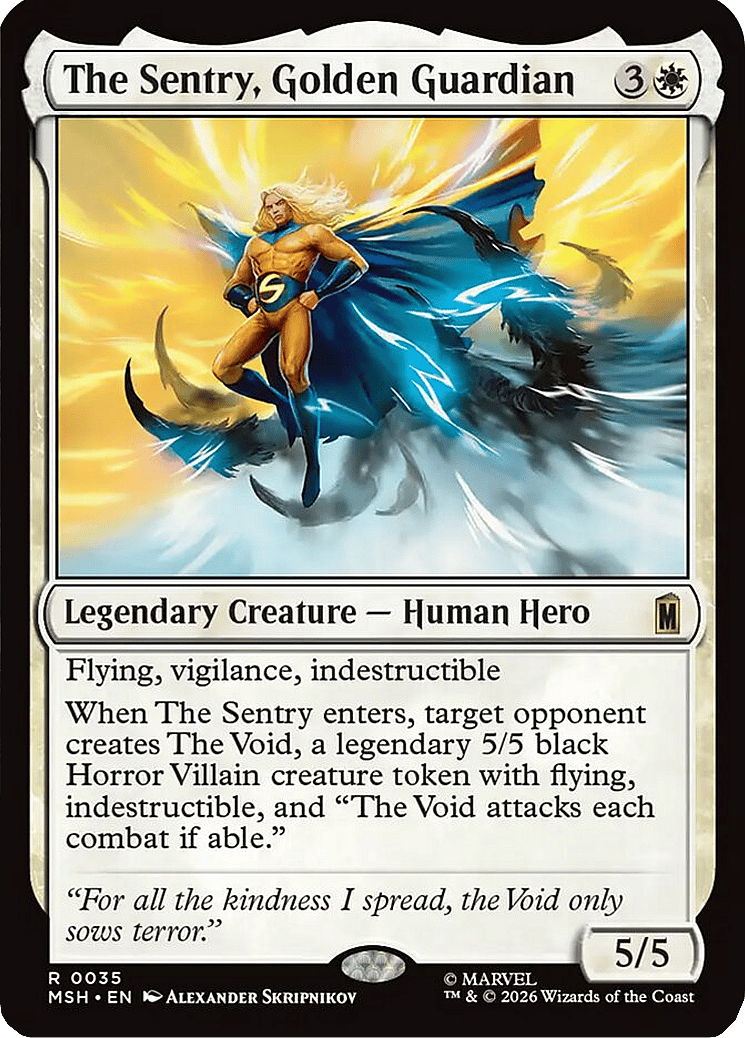

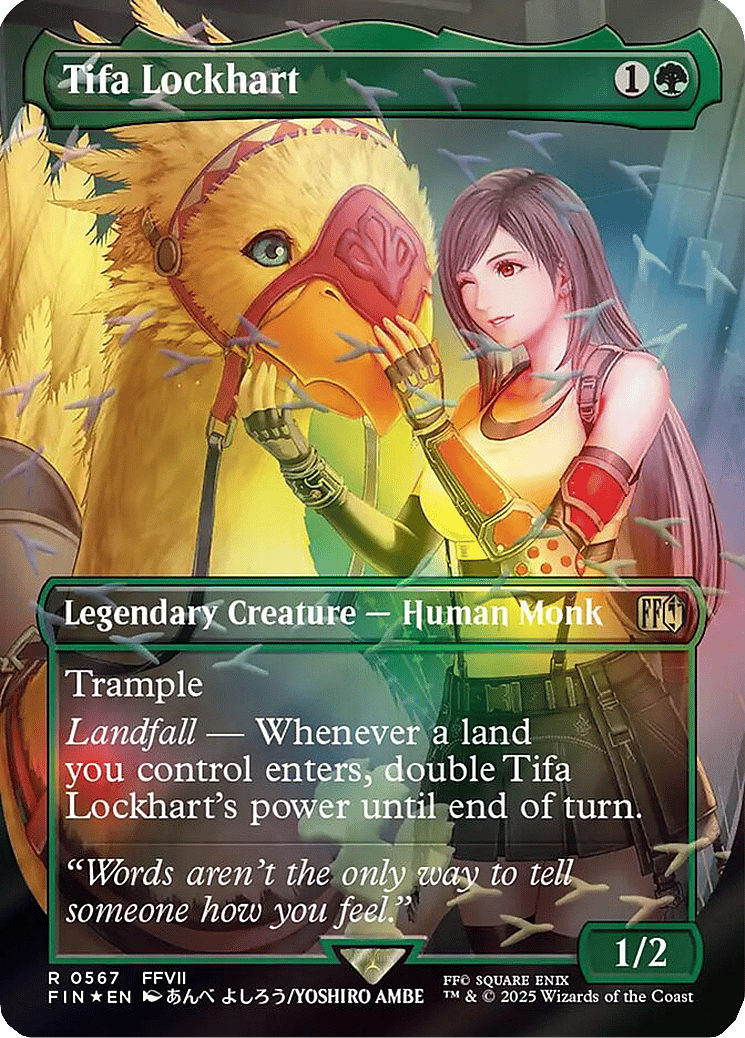

Asked last October during the company’s Q3 2025 earnings call as to whether any of 2026’s four Universes Beyond sets – Teenage Mutant Ninja Turtles, Marvel Super Heroes, The Hobbit and Star Trek – “could actually be bigger than Final Fantasy“, Hasbro VP of investor relations Fred Wightman declared, “Final Fantasy is a record breaking set. It’s already the biggest set in Magic’s history. I won’t tell you which one next year we think could rival or beat Final Fantasy, but we definitely see at least one that we think can do that.”

“I mean, this is a great deal for Magic: The Gathering in terms of, hey, we get access to some of the premier IP in the world,” he said of their overall Universes Beyond efforts. “It’s a great opportunity for the partners because really there’s never been an opportunity for them to access the trading card business, certainly at the scale Magic: The Gathering is delivering for them. We pretty much have had our pick of partners. I think if you can conceive of a collaboration that we could do with Magic: The Gathering, we probably have inked a deal or are in conversations on a deal on that.”

However, this enthusiasm seemed all but absent during the company’s recent Q4 2025 earnings call, which saw absolutely zero reference from Hasbro leadership to their previous Final Fantasy comparison.

Speaking to Magic’s future, CEO Chris Cocks asserted, “Magic delivered a record fourth quarter and grew sales nearly 60% for the full year. We have a powerful lineup in 2026. It includes original IP like Lorwyn and Strixhaven, alongside a blockbuster slate of Universes Beyond collaborations including Teenage Mutant Ninja Turtles, Marvel Super Heroes, The Hobbit and Star Trek.

“Avatar: The Last Airbender, which launched in late November, is now the third-highest-selling set in Magic’s history, trailing only The Lord of the Rings and Final Fantasy. At the same time, Secret Lair delivered its largest quarter ever, and backlist sales once again set a record. This balance of tentpole releases, premium offerings, and evergreen play reflects how the Magic system is designed to perform. That momentum has carried into the new year.”

Getting more into the technical weeds, Wightman forecasted, “We expect operating margins to be between 24%-25% for the year, reflecting continued operating leverage and disciplined execution. We expect adjusted EBITDA to be in the range of $1.4-$1.45 billion. At the segment level, Wizards is expected to deliver mid-single-digit revenue growth, supported by a healthy release cadence and continued engagement across the Magic ecosystem.”

Later pressed on their lowered financial predictions during the Q&A portion of the call, Hasbro CFO and COO Gian Goetter avoided directly addressing their shift in rhetoric but did attribute the revised numbers on the cadence of their release schedule.

“We expect operating margins to be between 24%-25% for the year, reflecting continued operating leverage and disciplined execution,” she told investors. “We expect adjusted EBITDA to be in the range of $1.4-$1.45 billion.”

From there, she ultimately reiterated Wightman’s forecast, concluding, “Wizards is expected to deliver mid-single-digit revenue growth, supported by a healthy release cadence and continued engagement across the Magic ecosystem.”