Financial Analyst Calls For Disney To Pull Marvel And Star Wars From Disney+ After ‘Ahsoka’s’ Premiere Numbers Show Significantly Declining Viewership

Financial analyst Valliant Renegade recently called for Marvel and Star Wars shows to be pulled from Disney+ after recently revealed Ahsoka viewership numbers show significantly declining viewership for Star Wars on the streaming platform.

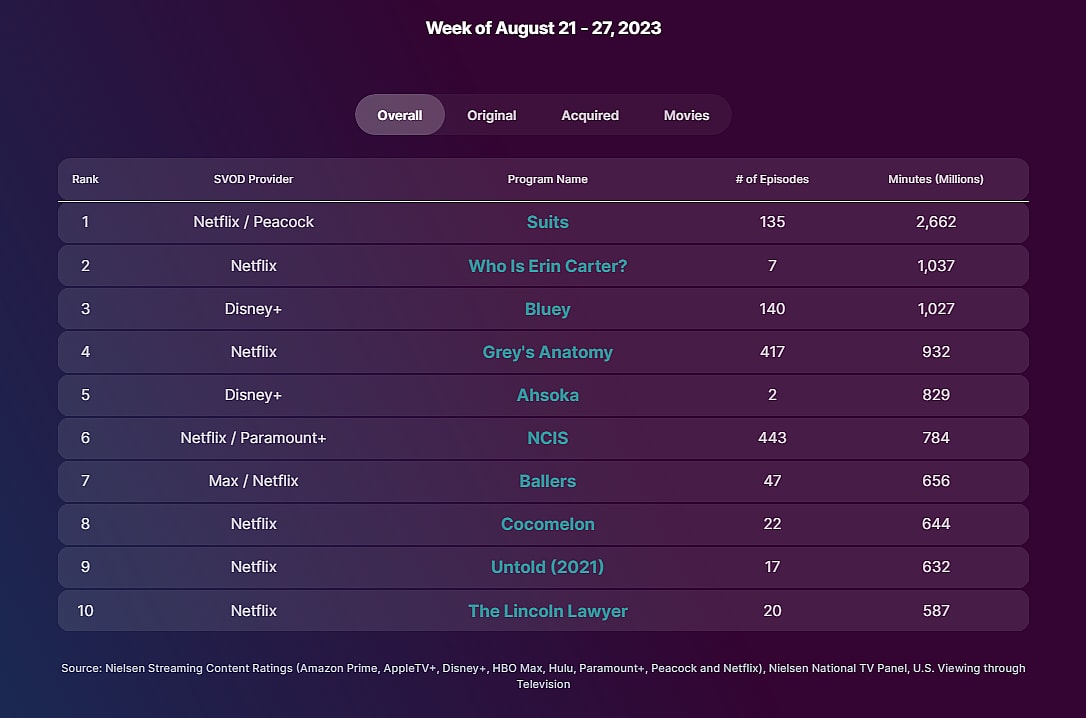

Nielsen recently released their viewership numbers for Ahsoka revealing the series’ two episode premiere only garnered 829 million minutes.

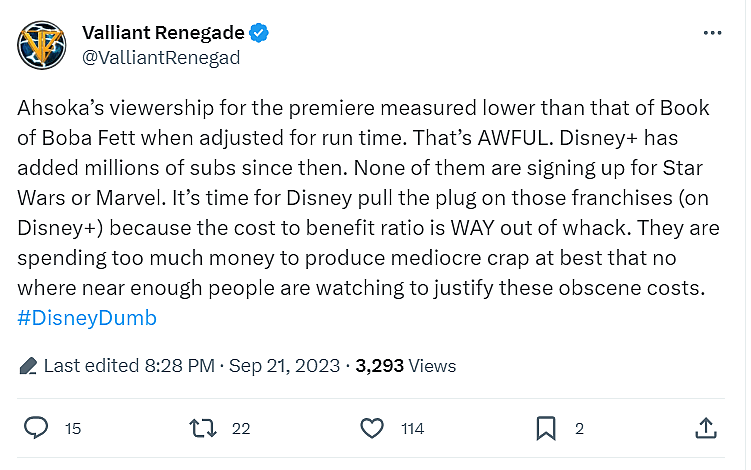

In reaction to these numbers, Valliant Renegade wrote on X, “Ahsoka’s viewership for the premiere measured lower than that of Book of Boba Fett when adjusted for run time. That’s AWFUL. Disney+ has added millions of subs since then. None of them are signing up for Star Wars or Marvel.”

He then declared, “It’s time for Disney pull the plug on those franchises (on Disney+) because the cost to benefit ratio is WAY out of whack. They are spending too much money to produce mediocre crap at best that no where near enough people are watching to justify these obscene costs. #DisneyDumb.”

If you do a basic run time calculation and simply divide the total minutes viewed as reported by Nielsen by the runtime of the two episodes (101 minutes) it comes out to 8.2 million.

As Valliant Renegade points out this is indeed less than The Book of Boba Fett premiere. That show premiered only one episode in its first week and clocked in at 389 million minutes according to Nielsen. Doing the same calculation viewership clocks in at 9.725 million given the show’s premiere runtime was 40 minutes.

The Walt Disney Company reported in their first quarter earnings report for fiscal 2022 that Disney+ had 42.9 million subscribers in the United States and Canada as of January 1, 2022. The Book of Boba Fett premiered on Disney+ on December 29, 2021.

The Walt Disney Company reported in their first quarter earnings report for fiscal 2022 that Disney+ had 42.9 million subscribers in the United States and Canada as of January 1, 2022. The Book of Boba Fett premiered on Disney+ on December 29, 2021.

The company’s most recent quarterly report reveals Disney+ subscriptions in the United States and Canada have increased to 46 million as of July 1, 2023. So, there is clearly some validity to the claim that the nearly 3 million people who subscribed to Disney+ are not doing so due to Star Wars.

RELATED: ‘Secret Invasion’ Premiere Viewership Fails To Break Into Nielsen’s Top 10 Streaming Programs

As for Marvel, Valliant Renegade did not make any comments about the recently released Secret Invasion, but the series premiered on the Nielsen charts with 461 million minutes viewed. Using the same run time calculation it comes out to 8.3 million.

Looking at a similar comparison to The Book of Boba Fett, Hawkeye released its first two episodes on November 24, 2021 and Nielsen reported they racked up 853 million minutes. Using the run time calculation it comes to 8.2 million.

Thus a similar conclusion can be drawn. The nearly 3 million new subscribers between the end of 2021 and today that Disney+ has added in North America are not subscribing for Star Wars and Marvel programs.

The Walt Disney Company does seem to recognize this at least when it comes to Marvel. Needham financial analyst Laura Martin attended a 120-person investor event at Walt Disney World and reported that the company’s CEO Bob Iger confirmed the company will “lower output by Marvel Studios and lower the cost per unit.”

This reflects comments Marvel Studios President Kevin Feige made back in February when he told Entertainment Weekly, “We want Marvel Studios and the MCU projects to really stand out and stand above. So, people will see that as we get further into Phase 5 and 6. The pace at which we’re putting out the Disney+ shows will change so they can each get a chance to shine.”

When asked if he would be spacing them out or putting out fewer shows per year, he responded, “Both, I think.”

Later in the interview he would reveal, “I think when we are doing about eight projects a year — and again, I said this is going to shift a little bit — they all have to be different. They all have to stand apart and stand alone and be different from one another.”

Iger also admitted back in May during the company’s Q2 FY23 Earnings Results webcast, “As we grow the business in terms of the global footprint, we realized that we made a lot of content that is not necessarily driving sub growth and we’re getting much more surgical about what it is we make.”

“So as we look to reduce content spend, we’re looking to reduce it in a way that should not have any impact at all on subs,” he asserted. “We believe there is an opportunity for us to focus more on real sub drivers.”

In fact, Iger went on to detail that many of the programs they created were negatively impacting the company’s financials due to their marketing costs outweighing the subscription revenue, “And one interesting example — I should throw marketing in too — where when you make a lot of content everything needs to be marketed. You’re spending a lot of money marketing things that are not going to have an impact on the bottom except negatively due to the marketing costs.”

“One thing we also know is that our films, those that are released theatrically, big tentpole movies, in particular, are great sub drivers, but we were spreading our marketing costs so thin that we were not allocating enough money to even market them when they came on the service.”

He then admitted that a number of programs were not driving any subscriptions at all, “As witnessed by the ones that are coming up including Avatar, Little Mermaid, Guardians of the Galaxy, Indiana Jones, Elemental, etc…, where we actually believe we have an opportunity to lean into those more, put the right marketing dollars against it, allocate more away from programming that was not driving any subs at all.”

“I guess this is part of the maturation process as we grow into a business that we had never been in. We are learning a lot more about it. Specifically, we are learning a lot more about how our content behaves on the service, and what it is consumers want,” he concluded.

The company would later “record a $1.5 billion impairment charge in its fiscal third quarter financial statements to adjust the carrying value of these content assets to fair value.”

As defined by Indeed, an impairment charge is “is a cost that shows a reduction in the carrying value of a specific asset on a balance sheet. This occurs when an asset’s book value exceeds its fair value in the market according to the Generally Accepted Accounting Principles (GAAP).”

What do you make of Valliant Renegade calling for Star Wars and Marvel Studios to be yanked off Disney+?