Despite Massive Switch 2 Sales Success, Nintendo Stock Price Drops 33% Over Last Five Months

Though nearly every metric shows Nintendo is currently enjoying an impressive run of Switch 2-led success, the drastic drop in their overall stock value across the last few months shows that investors still have some major concerns regarding the company’s future performande.

Per a report by Game Spark (as machine translated via DeepL), Nintendo’s stock price in Japan has fallen an estimated 30-33% over the last five months, with its January 13th closing price of ¥9,950 JPY (estimated $62.69 USD) representing the first time shares have fallen below ¥10,000 JPY ($63.03 USD) since April 2025.

Notably, this drop comes despite the gangbusters debut of Switch 2, which soon after its June 2025 release managed to prove itself the Nintendo’s fastest-selling console, if not the fastest-selling of all-time.

As of September 2025, 10.36 million units have been sold, along with 20.62 million units of software.

Fiscal results for Nintendo’s last six months reveal they performed better than predicted, so much so that they were confident enough to post both an increased fiscal forecast as well as a specific 26.7% rise in expected Switch 2 hardware sales, their estimates jumping from 15 million to 19 million.

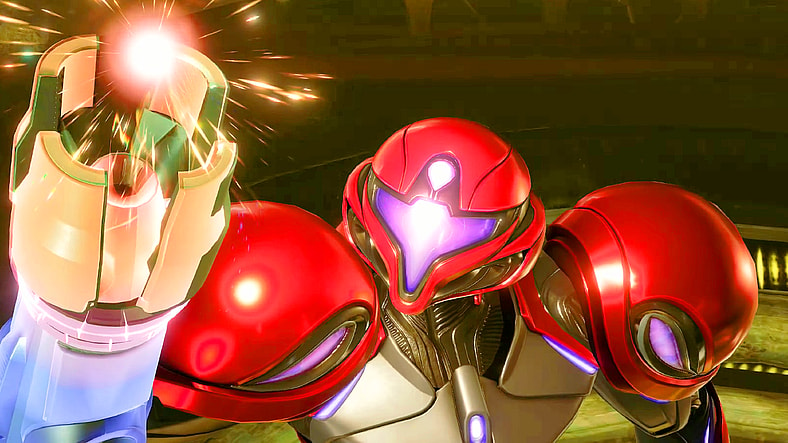

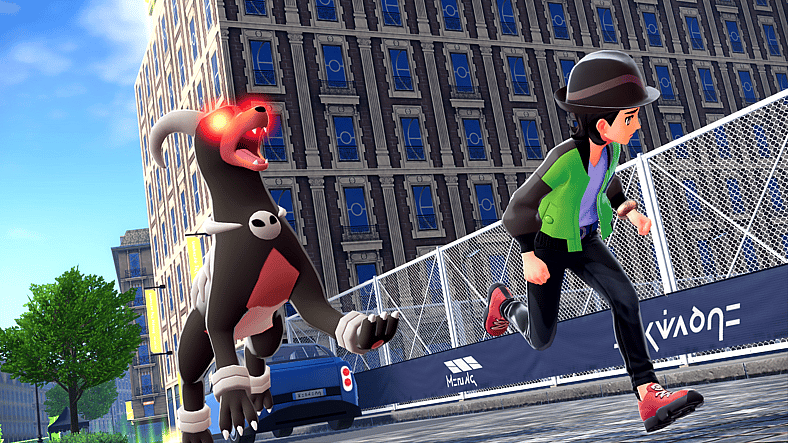

So why the mismatch between share price and sales? According to Games Spark, one major factor is the fact the “slight” lack of big titles either available or incoming that could properly seize on the Switch 2’s momentum, including exclusives like Mario Kart World, Donkey Kong Bananza, and Kirby Air Riders.

The uncertainty is further caused as “concerns exist that operating profit growth may not match the pace of sales,” which will sadly be hard to adjust for due to low-profit margins from selling console, with a further hammer-blow expected from the surge in RAM prices due to AI, which Game Spark theorizes will “likely to continue squeezing profits for the next few years.”

Outside of Games Spark, Chris Scullion of VGC speculates that this drop was partly caused by the US’ current economic instability, especially as Switch 2 sales over Christmas 2025 were 35% lower across the country when compared to its predecessor during its first holiday season.

He also raised the uncertainty surrounding the Trump administration’s fly-by-night tariff policy as a potential cause for caution, as the possibility that any future tax increases upon any country’s exports could raise Switch 2 prices – and thus prompt a drop in demand – overnight.

In addressing the Switch 2’s lower profit margin, Nintendo president Shuntaro Furukawa told Japanese news outlet Kyoto Shimbun (and machine translated by VGC from behind it’s paywall) explained, “Hardware profitability depends on factors like component procurement conditions, cost reductions through mass production, and the impact of exchange rates and tariffs.”

“It’s difficult to generalize. Fundamentally, we aim to address this by advancing component procurement over the medium to long term. We procure from suppliers based on our medium- to long-term business plans, but the current memory market is very volatile. There is no immediate impact on earnings, but it is something we must monitor closely.

“While it’s difficult to accurately gauge the future impact, our basic policy is to recognize tariffs as a cost and pass them on to prices as much as possible, not just in the US. On the other hand, this is a crucial period for our game business as we promote the adoption of new hardware and maintain the momentum of our platforms. We are working on this while carefully considering the situation.”

Previously, Nintendo were criticized for the cost of the Switch 2 and its exclusives, particularly as they were typically perceived in past generations s the ‘wallet friendly’ console manufacturer.

Former Nintendo of America President, the ironically named Doug Bowser, revealed the prices were chosen before any tariffs proposed by US President Donald Trump, though Furukawa later warned that future policy changes could also lead to increased costs.