‘Marvelous’ Financial Results For Q1 2022 Sees A Decline In Their Video Game Business In Every Metric

Marvelous’ report for their first fiscal quarter of the year has revealed their video game business is down by every metric declared.

Source: No More Heroes III (2021), XSEED Games

The report notes that in its first quarter of the fiscal year — April 1st to June 30th — Marvelous’ net sales were down 17.8% from the same period last year (¥5,319 million JPY, or an estimated $39.8 million USD).

Likewise, operating profit fell 46.7% (to ¥780 million JPY, $5.8 million USD), ordinary profit by 23.2% (¥1,132 million JPY, $8.47 million USD), and profit attributable to owners of parent by 30% (¥752 million JPY, $5.6 million USD).

Shadowverse: Champion’s Battle (2021), XSEED Games

Moving onto the “Digital Contents Business,” games Marvelous published, the report notes that “sales fell short of the target” for the zombie survival-action multi-platform title Deadcraft; released in May of this year.

The report further states “as a reactionary decline following the strong sales of ‘Rune Factory 5,’ which was launched in May of the previous fiscal year, sales and profit decreased from the same period of the previous fiscal year.” In other words, the poor sales are blamed in part to Rune Factory 5 doing so well by comparison- having launched just before Q1 2021.

Source: Rune Factory 5 (2022), XSEED Games

Logres of Swords and Sorcery: Goddess of Ancient and Shinovi Master – Senran Kagura New Link are noted as having well-received collaboration and anniversary events, while The Thousand Musketeers: Rhodoknight saw an increased number of users thanks to its half-year anniversary event “but its contribution to earnings was limited.”

Despite the few positive notes, Marvelous state net sales were down 32.6% from the same period in the prior year (¥3,030 million JPY, $22.7 million USD), and segment profit was down 82.5% (¥252 million JPY, $1.889 million USD). The aforementioned trio of titles are all mobile titles.

Source: Shinovi Master – Senran Kagura New Link (2018), Marvelous

There was more uplifting news for Marvelous in other areas however. The Amusement Business segment saw net sale totals up 40.9% (¥1,726 million JPY, $12.9 million USD), and segment profit up 101.9% (¥702 million JPY, $5.26 million USD).

Even so, Audio and Visual Business saw net sale totals down 24.9% (¥562 million JPY, $4.2 million USD), but segment profit — thanks to “a significant increase in profit” — saw a 1172% increase (from ¥18 million JPY to ¥229 million JPY, $1.7 million USD). It should be noted that Audio and Visual Business includes animated and stage shows; both hindered during COVID-19 lockdown orders in 2021.

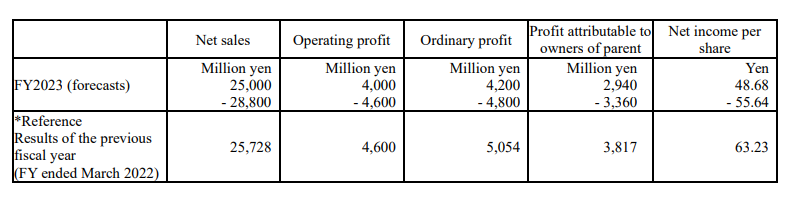

“The full-year financial forecast for the fiscal year ending March 2023 had not been determined due to the difficulty of making a reasonable calculation of the impact on the business amid uncertainty over the resolution of COVID-19,” the report concludes. Nonetheless, FY2023 forecasts were slashed by over half in net sales, operating profit, ordinary profit, profit attributable to owners of parent, and net income per

share.

Source: Consolidated Financial Results for the First Quarter of the Fiscal Year Ending March 31, 2023

(Three Months Ended June 30, 2022) (Based on J-GAAP), via Marvelous Corporate/IR

While games are only part of Marvelous business, they are notably the vast majority of failures in the quarter compared to amusement and audio/visual business. A potential reason the they could be suffering in that area is due to the increasing hostility towards fan service in video games from games journalists and activists, and one of their most well-known titles being the fan-service heavy Senran Kagura series.

In October 2018, a Japanese developer claimed Sony Interactive Entertainment had they demanded they and other Japanese studios censor sexual content in their games on PlayStation consoles.

Source: Senran Kagura Estival Versus (2015), Marvelous Inc.

Later that year, Sony Interactive Japan Asia President Atsushi Morita said, regarding how the policy would balance with freedom of expression, “About the censorship, we tried to meet global standards.” A Sony spokeswoman confirmed the existence of the policy in 2019, citing the Me Too movement and popularity of video game streaming on YouTube and Twitch for its existence.

Senran Kagura producer Kenichiro Takaki left Marvelous in 2019, citing the censorship as his main reason for leaving, and feeling the policies had gone too far. Even so, it should be noted the Senran Kagura series has continued with less fan-service, along with new games by Takaki’s Honey∞Parade Games such as Kandagawa Jet Girls, and fan-service title remake Akiba’s Trip: Hellbound & Debriefed.

Source: Sakuna: Of Rice and Ruin (2020), XSEED Games

It should also be noted that Marvelous publish more than fan-service games. Recent major releases for Marvelous have included No More Heroes III, Daemon X Machina, Rune Factory 5, Story of Seasons: Pioneers of Olive Town, Sakuna: Of Rice and Ruin, Corpse Party (2021), and Shadowverse: Champion’s Battle. The studio also publishes the Ys and The Legend of Heroes series.

Even so, according to review aggregator site Metacritic, none of titles from Marvelous or US subsidiary XSEED Games launched since June 2021 have exceeded a Metascore of 77. Story of Seasons: Friends of Mineral Town has a userscore of 8.1 on PC and Switch, though Deadcraft’s only userscore comes from Nintendo Switch, with four user reviews culminating in an 8.5.

Source: Deadcraft (2022), XSEED Games

What do you chalk up Marvelous’ recent performance to? Let us know on social media and in the comments below.

More About:Video Games