Nelson Peltz Explains His Objectives And Tactics When Turning Around Faltering Companies Like The Walt Disney Company

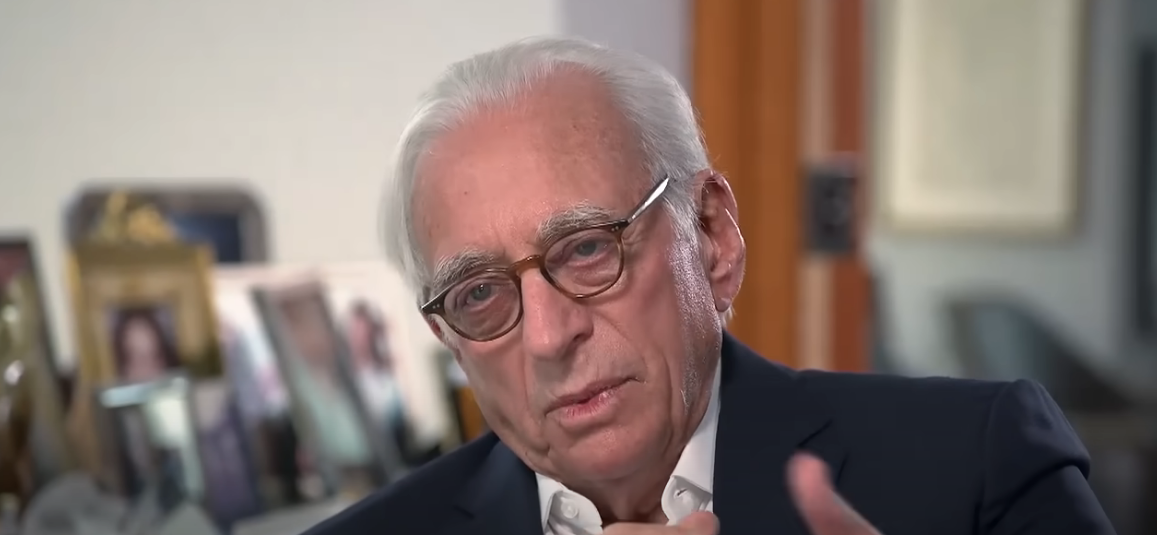

Investor Nelson Peltz, the Founding Partner of Trian Fund Management, explains his objectives and tactics when turning around companies. Peltz recently engaged in a proxy war with The Walt Disney Company and is reportedly looking to take over multiple seats on the company’s board of directors.

Nelson Peltz via David Rubenstein YouTube

In January this year, Trian Fund Management nominated Peltz for election to the Disney board claiming the company’s share price has declined to “near an 8-year low,” the company has “materially underperformed the S&P 500 over 1-year, 3-year, 5-year and 10-year periods by -24%, -60%, -66%, and -116% respectively.”

The company also noted Disney’s “operating performance has deteriorated, including a 50% decline in adjusted Earnings Per Share since FY 2018 despite Parks profitability surpassing historical levels.”

After citing these poor figures, Trian declared that Disney’s “current problems are primarily self-inflicted and need to be addresses.”

Robert A. Iger, Executive Chairman and Chairman of the Board, at The Walt Disney Company’s Investor Day 2020.

From there, Trian laid out that Peltz’s election to the board would be allow him to craft an “effective succession plan” and “align compensation with performance.” He could “improve [Direct-to-Consumer] operating margins, eliminate redundant and/or excessive costs, [and] refocus the creative engine to drive profitable growth.”

Furthermore Trian wants to “enhance accountability on capital allocation [and] reinstate the dividend by FY 2025.”

Concept art for the Star Wars: Galactic Starcruiser from its Official Website

In February, Trian would drop the proxy battle noting in a press release, ““We congratulate Disney and Bob Iger on their recently announced operating initiatives, which are a win for all shareholders and broadly align with our thinking. We are pleased with the role that Trian was able to play in helping to focus the Board to take decisive actions which we believe will lead to better financial results. We were also pleased to see the Company’s pledge to restore the dividend.”

However, a new report from CNBC indicates Peltz is ready to reignite the proxy battle and Trian has increased its shares in Disney to more than 30 million. In January Trian noted they only controlled 9.4 million shares.

Not only has Peltz and Trian significantly increased the number of shares in Disney, but instead of just one seat on the board for Peltz, Trian wants multiple seats now.

Mickey Mouse via Disney Parks YouTube

Given Peltz clearly wants to make changes to The Walt Disney Company it would be instructive to know how he goes about making changes to previous companies that were in The Walt Disney Company’s situation.

Peltz spoke with David Rubenstein of Bloomberg Wealth back in June 2022 where he explained how he goes about fixing and repairing companies.

He told Rubenstein, “We’re not an active investor. What we see is what we see really companies that we think were once great, have lost their way, and that we have a plan for them to get back to greatness again. And that’s what we do.”

“We’re not there to leverage up these companies,” he continued. “We’re not there to split them up. We’re not there to do all the terrible things that typically go along with the term activist. We’re just trying to get these companies to operate better, the way they used to.”

Mickey and Minnie Mouse at Walt Disney World Photo Credit: Adnan Islam from NY, USA, CC BY 2.0 <https://creativecommons.org/licenses/by/2.0>, via Wikimedia Commons

After Rubenstein lays out that Peltz buys up a bunch of public stock in companies and then notifies a CEO that he’s a big shareholder, Peltz explains how the interactions with the CEOs can go, “Sometimes no one is thrilled that we’re there. Some are much more receptive to hear. what we’ve got to say. We put together a white paper to go over with management. And that white paper stays private as long as we’re in conversation.

“And if we want a board seat when we think that they’re ready to give us a board seat it will always stay private,” he relayed. “But if they refuse to then we make that white paper public.”

Mark Hamill as Luke Skywalker in The Last Jedi (2017), Lucasfilm

When asked if he could how many times CEOs welcomed or rebuffed his advice, he stated, “I can’t tell you, but I don’t remember anybody ever saying the former. But not very often have they have been as tough as you said on the latter.”

“Clearly, they’re not thrilled to see us. But what usually happens is that these stocks go up. And they go up nicely for the right reasons because sales have gone up, market shares have gone up, earnings clearly have gone up. And we tell them what we think they’re doing wrong,” he asserted.

LOS ANGELES, CALIFORNIA – FEBRUARY 06: (L-R) The Walt Disney Company CEO Bob Iger and Disney Studios Content Chairman Alan Bergman attend the Ant-Man and The Wasp Quantumania world premiere at Regency Village Theatre in Westwood, California on February 06, 2023. (Photo by Alberto E. Rodriguez/Getty Images for Disney)

Peltz then provided an example with Procter and Gamble, “The most recent one, which is really interesting was Procter and Gamble. Procter and Gamble was about a $70 stock for almost 10 years. The best, the biggest consumer company in the world, but really giving away market share here and there wherever anybody was challenging them.”

“We didn’t think the company was structured properly. So we went to them and gave them a plan. And said, ‘Look, there’s one CEO. No one has [profit and loss] responsibility in this company anywhere other than the CEO. So there’s really not ability to impact things because everything was a matrixed organization.”

Peltz then recalled, “We gave them our structure, they rejected it. We had a proxy fight. We finally won our board seat and the shareholders won.”

HOLLYWOOD, CALIFORNIA – APRIL 27: (L-R) The Walt Disney Company Chief Executive Officer Bob Iger and Chris Pratt attend the Guardians of the Galaxy Vol. 3 World Premiere at the Dolby Theatre in Hollywood, California on April 27, 2023. (Photo by Charley Gallay/Getty Images for Disney)

Later in the interview, Peltz explains what happens when he gets on to the board of directors, “Well, first of all we don’t bring that to the board room. Our time is spent with the CEO, the chairman, the CFO, and [we] share our plans with them outside the boardroom. We try never to solve an issue in a board room. It’s always best done the day before, the week before, outside that room.”

“We wouldn’t be there if they really were doing well,” he asserted. “So it’s really hard for them to straight face and tell us, ‘We’re doing well.’ And we present them with a plan.”

Nelson Peltz via David Rubenstein YouTube

From there he used Heinz as an example, “Look at Heinz, which was our first really aggressive salvo. We bought. We became a very large shareholder of Heinz. We went to them with a plan. They didn’t want any part of us. They didn’t know who we were. And Heinz had had a 10-year stint of flat to down sales and earnings the same. And what we saw at Heinz very clearly is that every quarter, every year, their direct market spend declined.”

“Ok, so everybody probably has a bottle of Heinz in their pantry. They key was how do you get it out of the pantry, on the table, and turn it upside down. That wasn’t happening,” he said. “So what we did is we said to them, ‘You’ve got to raise your direct selling expense.’ Well, why did it keep going down? You know, yourself, if there are estimates of earnings in the next quarter and its the middle of the quarter and your CFO comes running in and says, ‘We’re not going to make consensus.’ There’s very little that you have impact on in that quarter for that quarter except advertising spend.”

Mickey Mouse waves good night in Walt Disney Studios Park, Disneyland, Paris via Animatronic Duo YouTube

He then shared what Heinz did, “So what they did is they cut advertising spend, made the quarter. But what was gonna happen in the next quarter? Where was the wind at their back for the next quarter to get sales going again?”

“So what happened is when we are all said and done at Heinz, advertising spend was about 1.5% of sales that’s probably what US Steel spends on advertising. When we left the company, we sold it to Buffett and the Brazilians, it was spending close 5% of sales and we had 36 straight quarters of organic sales increases. There was no other consumer company could say that,” he recalled.

Tony Stark (Robert Downey Jr.) takes the stage at the Stark Expo in Iron Man 2 (2010), Marvel Studios

When asked if he would ever just provide advice without going on the board, Peltz responded, “We do do that sometimes. It’s not a matter of wanting to. It’s a matter of how receptive management is to our suggestions. Ferguson is a company we bought a lot of stock in, never got on the board, never asked for a board seat, really had a great relationship as we do today with management. No need for us to go on the board.”

At one point we were the largest share owner of Domino’s. We spent time with those guys, did not feel that they needed us on the board, and they did great things. We sold the stock too early, but made a lot of money on it. But so we have those relationships at times,” he concluded.

(L-R): Sabine Wren (Natasha Liu Bordizzo), Ahsoka Tano (Rosario Dawson) and Ezra Bridger (Eman Esfandi) with Night Troopers in Lucasfilm’s STAR WARS: AHSOKA, exclusively on Disney+. ©2023 Lucasfilm Ltd. & TM. All Rights Reserved

What do you make of Nelson Peltz’s strategy and tactics and how do you think he will move forward with The Walt Disney Company?

More About:Comic Books Movies Television