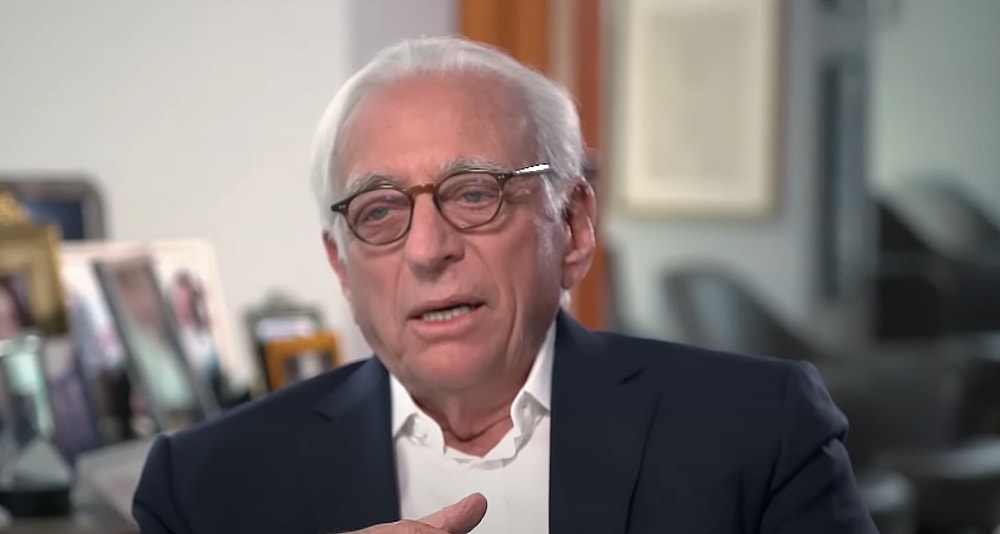

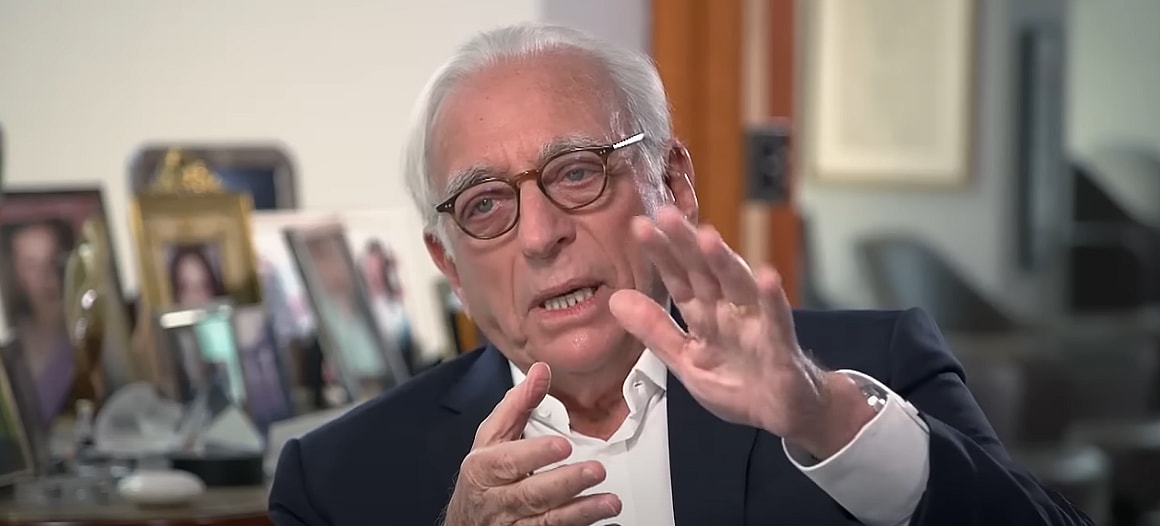

Report: Ike Perlmutter Deepens His Alliance With Nelson Peltz, Hands Disney Stock Over As Peltz Wants To “Refocus The Creative Engine To Drive Profitable Growth”

A new report details that Ike Perlmutter and Nelson Peltz have deepened their alliance as Peltz and his Trian Fund Management group get ready for a proxy war with Bob Iger and The Walt Disney Company.

Pelrmutter initially aided Peltz as he attempted to gain a board seat back in January by “calling Disney directors and brokering meetings between Peltz and then-CEO Bob Chapek” reports The Walt Street Journal.

At the time Peltz was seeking a board seat for himself using 9.4 million shares valued at $900 million as leverage. He believed that “Disney is one of the most advantaged consumer entertainment companies in the world, with unrivaled global scale, irreplaceable brands, and opportunities to monetize its intellectual property (“IP”) better than its peers by leveraging the Disney “flywheel” (e.g., networks, theme parks, consumer products, etc.)”

However, he he also believed “that Disney’s recent performance reflects the hard truth that it is a company in crisis with many challenges weighing on investor sentiment.”

To that end he identified multiple areas where the company was struggling including: Corporate governance, strategy and operations, and capital allocation.

In order to fix this Peltz and Trian indicated they would help the company “develop an effective succession plan, align compensation with performance, improve DTC (Direct-to-Consumer) operating margins, eliminate redundant and/or excessive costs, refocus the creative engine to drive profitable growth, enhance accountability on capital allocation, and reinstate the dividend by FY 2025.”

Peltz would end his proxy battle for the board seat in February with Trian announcing in a press release, “We congratulate Disney and Bob Iger on their recently announced operating initiatives, which are a win for all shareholders and broadly align with our thinking. We are pleased with the role that Trian was able to play in helping to focus the Board to take decisive actions which we believe will lead to better financial results. We were also pleased to see the Company’s pledge to restore the dividend.”

He added, “Accordingly, we are withdrawing our nomination of Nelson Peltz as a director to allow the Board and Disney’s leadership team to focus on creating long-term shareholder value without the distraction of a proxy contest. Now it’s about execution and ensuring best in class corporate governance going forward. We will be watching and rooting for the Company’s success.”

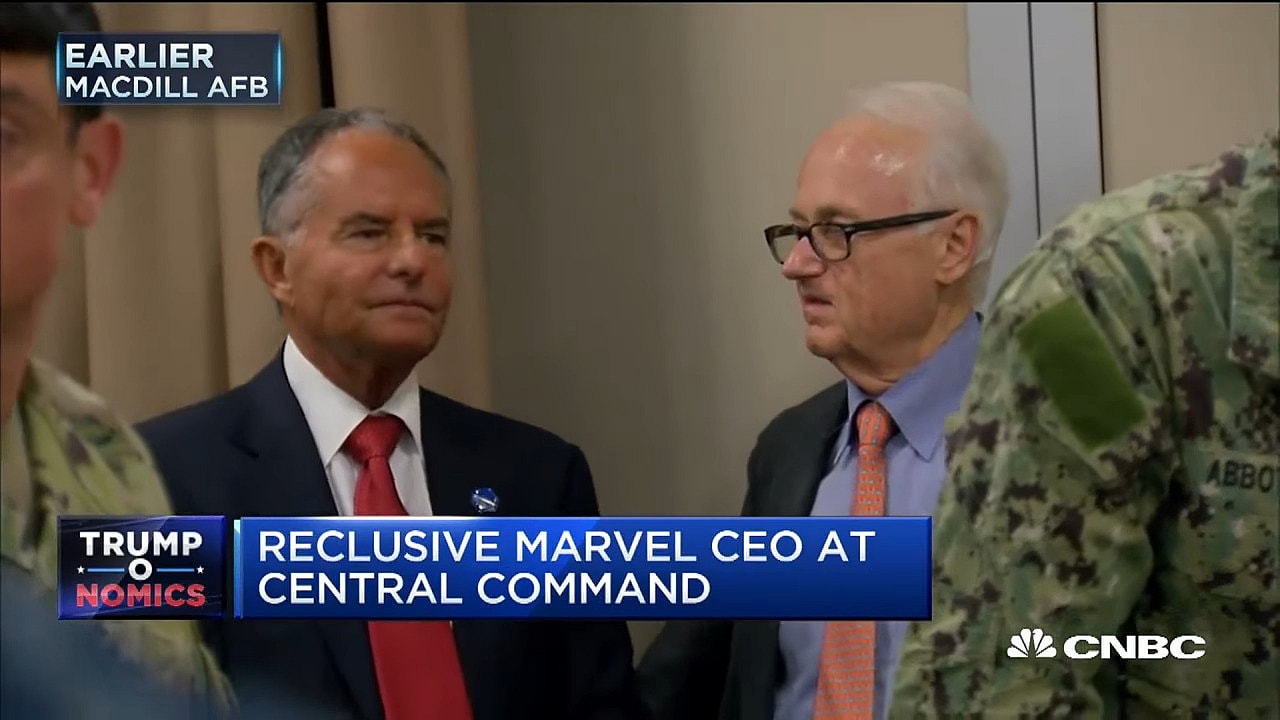

However, since the proxy battle ended Perlmutter was let go from his position at Marvel Entertainment with the executive telling The Wall Street Journal he was fired because he wanted to keep costs down.

He said, “I have no doubt that my termination was based on fundamental differences in business between my thinking and Disney leadership, because I care about return on investment.”

Specifically Perlmutter noted his focus was not on how big the box office grosses, and claimed only people in Hollywood focus on box office gross, “All they talk about is box office, box office. I care about the bottom line. I don’t care how big the box office is. Only people in Hollywood talk about box office.”

He also disputed claims he was let go due to redundancies and downsizing at the company, “It was merely a convenient excuse to get rid of a longtime executive who dared to challenge the company’s way of doing business.”

Not only did Perlmutter allege he was let go due to his desire to keep costs low, but The Walt Disney Company has rolled out a string of theatrical losses likely losing the company tens of millions of dollars if not more.

It also does not appear to be growing its flagship streaming service Disney+ and CEO Bob Iger has also admitted the company created a number of programs for the streaming service that were not driving subscriptions. The company’s stock price has also dipped below $80.

Towards the beginning of this month, CNBC reported Peltz and Trian were gearing up for another proxy battle and had increased his shares in The Walt Disney Company to around 30 million.

Not only did the report detail Peltz had increased his shares, but it revealed Trian was aiming for not just one board seat, but they now want multiple board seats.

A new report in The Wall Street Journal reveals that Peltz’s increase in Disney shares is due to an alliance with Perlmutter. Laurent Thomas and Robbie Whelan at The Wall Street Journal detail, “Perlmutter said he has entrusted his stake in Disney to Peltz’s Trian Fund Management as it prepares to press the company for multiple board seats. Trian’s holding in the company totals about 33 million shares, including stock that the investment firm controls under an arrangement that gives Peltz’s firm sole voting power over Perlmutter’s shares, according to people familiar with the matter.”

Perlmutter has not only given Peltz and Trian control of his shares, but the report notes he plans to urge the board to “immediately welcome one or more Trian board candidates.”

“While I was a Disney employee, I was not comfortable publicly stating my views on the company and its performance,” Perlmutter stated. “As someone with a large economic interest in Disney’s success, I can no longer watch the business underachieve its great potential.”

As for Perlmutter potentially getting a board seat, the report claims, “Trian isn’t seeking to add Perlmutter, who was chairman of Marvel Entertainment until March, to Disney’s board, nor is the firm asking Disney to rehire him, the people said.”

What do you make of Perlmutter deepening his alliance with Peltz as they gear up for a new proxy battle with Bob Iger and the Disney board?