Tencent And NetEase Lose Billions In Stock Value After China Sets Strict Limits On Video Game Monetization, Bans Gacha Mechanics From Young Players

In a development that’s likely to be lamented by investors but celebrated by those who believe the overall medium has been made objectively worse over the years thanks to the shameless attempts by such entities to monetize it, two of the biggest players in the country’s mobile gaming sphere, Tencent and NetEase, have seen billions wiped off of their respective stock prices after the Chinese government introduced new local regulations regarding video game monetization.

RELATED: Atlus Censors Classic Demon Designs For China-Exclusive Gacha Game ‘Persona 5: The Phantom X’

First announced by the East Asian country on December 22nd, per a recap provided by Reuters, these new rules specify that developers:

- May no longer offer ‘sequential interaction rewards’, such as daily login rewards or bonuses relating to making several purchases in a row

- Must limit how much money a player can add to their ‘digital wallets’ for in-game purchases

- Ban the practice of speculation and auctioning from their in-game economies

- Must not offer any gacha mechanics – i.e. chance-based, blind-box reward systems such as loot boxes or booster packs – to minors

- Must store their servers within China itself (as of writing, it is unknown whether this rule refers to an entire company’s server network, those relating to any game released within the country, or those specifically used to host Chinese user data)

Meanwhile, a further stipulation to these new regulations now requires China’s regulatory boards to process any and all requests from foreign companies to sell a game inside the country’s borders within 60 days of their initial filings.

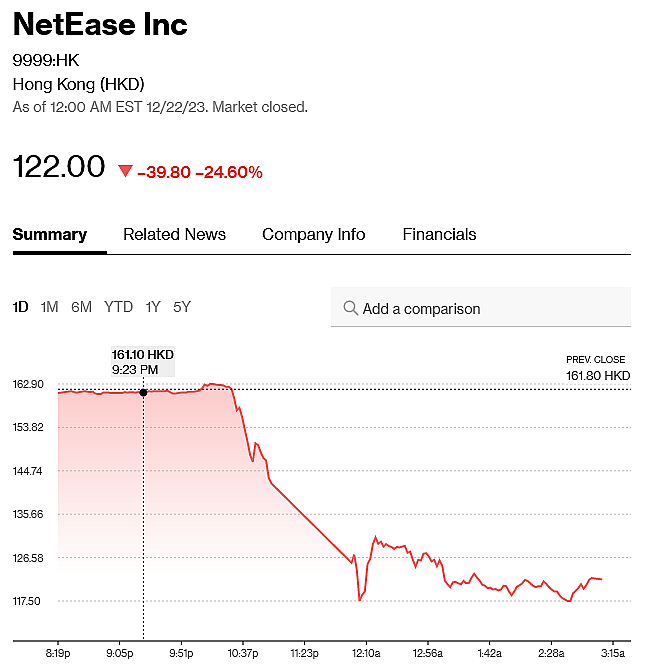

And it was as a result of these new rules taking away what were essentially their main methods of revenue generation that two of China’s biggest tech conglomerates-slash-gaming industry giants, Goddess of Victory: Nikke publisher Tencent and Diablo Immortal co-developer NetEase, saw their respective values on the Hong Kong stock exchange take an absolutely brutal nosedive ahead of the Christmas weekend.

Opening at roughly 161 HKD ($20 USD) per share on the morning of the announcement, NetEase fell by nearly 25% to close at 122 HKD ($16.62 USD) apiece, in the process wiping out roughly $125 Billion USD from the company’s total evaluation.

Likewise, after starting the day at 317 HKD ($27.80 USD), Tencent dropped 12.35% before closing at 274 HKD ($35 USD) and ultimately losing about $425 Billion in market cap.

Pressed by Reuters for comment on these new rules, Tencent Games’ VP Vigo Zhang claimed that the company does not believe it will need to change “its reasonable business model or operations” due to their strict and ongoing self-application of the country’s current regulatory standards.

Zhang also noted that thanks to the Chinese government’s previous attempts to address youth health concerns regarding video games, such as limiting play time and preventing anyone younger than 16 from becoming a streamer, time and money investments from minors into Tencent games has been at an all-time low.

Meanwhile, NetEase declined to speak on the matter.

According to the aforementioned news outlet, the Chinese government will be taking public comment on the new policies until January 22nd, 2024.